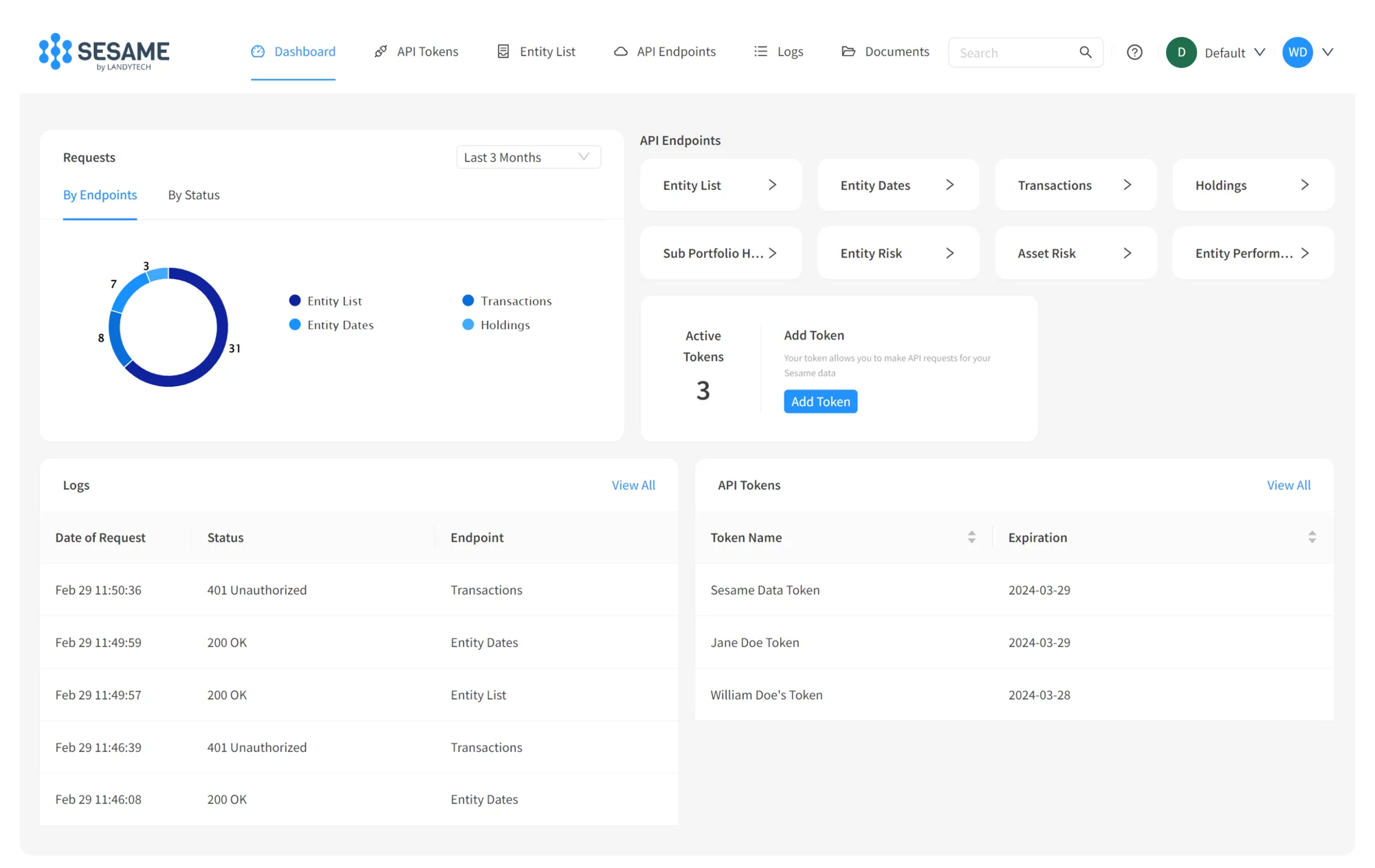

The complete investment data aggregation, analytics and reporting platform

The future of trust bookkeeping and monitoring

How trust companies are using Sesame to grow

Automated bookkeeping

Put your bookkeeping on autopilot

Receive a refreshed daily feed of all client investment transactions and holdings data from banks, custodians and investment managers.

Use a single automated data feed to provide all your internal ERP and accounting systems with a near-real-time view of investment portfolio valuations and movements.

Digitised Portfolio Monitoring

Take your portfolio monitoring to the next level

Know exactly what is going on in client trusts at any time, across investments, cash and private assets.

Fuel your investment committee meetings and client reporting with near-real-time data.

Consolidated Wealth Reporting

Become your clients' most trusted advisor

Act as a seamless extension of your clients' private office teams with white-labelled data management and consolidated wealth reporting services.

Brochure

Sesame for Trust Companies

Whitepaper

Automated Bookkeeping: Building a digital future for Trustees

Buyers Guide

Choosing the Right Trust Reporting Software

Testimonials

You'll be in great company

Hear what our amazing clients have to say about working with us.

At Ocorian, we are always seeking solutions that solve our clients’ complex problems. By partnering with Landytech and adopting Sesame, we set a new industry standard, offering our clients best-in-class consolidated wealth reporting. It ensures we can continue to deliver the exceptional service they expect from our expert team and facilitate their efficient, informed, and timely decision-making process.

Ocorian

Sesame has provided us with the consolidated data to substantiate discussions with clients around their wider wealth strategies, and the ability to anticipate challenges within portfolios and proactively mitigate them. Sesame has given us the tools to not only work smarter but to work more holistically too, with our clients reaping the benefit.

Accuro

Our adoption of Landytech’s Sesame is part of the Scouting Group's growth strategy. Having continuously evolving software sets us spart in the Family Office landscape and empowers us in our commitment to advancing investment management in Italy and Europe. This partnership allows us to provide clients with an international multidisciplinary team of experts with proven experience to analyse new trends and offer an innovative service.

Scouting SIM Family Advisors

Landytech's solution - Sesame - has allowed our team to understand in- depth portfolios' risk and performance by security and industry (and numerous other factors). The analytical engine of the software is very robust, yet the product is easy to use. Landytech's proactive efforts to manage risk, attention to detail, and responsiveness to new matters is unsurpassed.

Kepler Liquid Strategies

Following an impressive demonstration of Landytech’s offering, we asked them to pitch alongside a reputable competitor. The decision to choose Landytech was unanimous. Their offering was far superior in terms of functionality, ease of use and presentation. During the course of our relationship, Landytech have delivered exactly what they promised and more. I cannot speak highly enough of both the platform and the team.

Guernsey-based Family Office

Ever since we started Tellworth, Landytech have been a business essential service for us. They have proved to be flexible, responsive, commercial and understanding of our changing needs as we grow the business. This year with the challenges we have all faced they have really stepped up; helping us to look at risk and exposures in new ways and enabling better client relationships in the process.

Tellworth Investments

Each family’s got to look at that reporting system and feel that it is theirs. It needs to be the right colour, it needs to be branded, it needs to be white-labelled, it needs to look like it's come from our office. Landytech have mastered that well for us. For reporting to evolve, you need to work with a dynamic team growing their business with the same enthusiasm as yours so the two grow together. Landytech tick those boxes.

UK-based Multi Family Office

Brooklands have been using Landytech extensively for both Risk and Compliance. We have been very impressed with the service that has been provided and also the accuracy of the data quality. The platform has been very useful to monitor risk for all of our funds at a click of a button.

Brooklands Fund Management

Landytech has developed a unique tool and solution for Family Offices. Sesame allows us to monitor a wide range of assets (traditional and alternatives), multi-currencies reports, a depth of data accessible in an organised manner.

Paris-based Multi Family Office

Landytech have proven to be open-minded, resourceful and trustworthy in all that they do. From the outset, they have been able to provide suggestions as to how we can best achieve our client reporting goals in a timely and accurate manner, offering innovative solutions to the challenges we face of bringing together data from disparate sources.

Skerryvore Asset Management

Sesame makes my life far easier. I can see everything in my portfolio in the detail I require and updated in real time – rather than a series of disparate and intermittent snapshots. Working with better information makes my investment management more effective and less stressful.

UK-based UHNWI

Shiprock Capital’s growth in the Global Distressed and Special Situations market has led us to partner with Landytech to strengthen our risk infrastructure and enhance our operational efficiency. Landytech's solution, Sesame, enables us to effectively mitigate risk at scale across our asset classes, access advanced analytics to make informed investment decisions, and streamline our reporting and data management workflows.

Shiprock Capital Management Limited

From the first meeting with Landytech, we were highly impressed by their commercial approach, efficient operating platform and experience. They have provided us with a robust risk management function that would be extremely challenging and expensive to implement within our own organisation. We were most fortunate to discover this firm and I would have no hesitation in recommending them.

UK-based Asset Manager

Frequently asked questions

How much does Sesame cost?

Our pricing is dependent on several factors including the number of managed feeds, legal entities, portfolios, assets and users. In order for us to give you a more accurate estimate we'll need a few more details from you. You can leave your details by filling in our contact us form, and one of our team will get back to you.

What reports can you create?

Sesame provides a wide range of templated reports including holdings, flows, performance (overview and contribution), allocation, risk, movements, costs, cash and more. One of the main benefits of Sesame is its report builder functionality, which enables users to create reports on the fly and at scale.

How do you consolidate private assets?

Sesame has a portfolio management system (PMS) specifically for private assets, allowing you to manage all of your private investments. From co-investments, to cars, to alternatives, Sesame allows the user to bulk import data, add transactions and positions, and update valuations.

What level of report customisation is available?

Our Report Builder enables you to fully customise all components within your report, add your businesses logos and utilise your brand colour palette. The reports will have the look and feel of a fully branded, marketing department-approved in-house solution.

How is data security maintained?

Landytech is ISO 27001 certified, and the Sesame infrastructure is fully hosted on the Microsoft Azure cloud. Azure provides a wide range of security tools and capabilities that we embrace. We insist on confidentiality, integrity, and availability of customer data, while also enabling transparent accountability. We follow security best practices at each level of our applications and we always take security into account in all our processes.

Do you offer a demo account or trial to see what the platform has to offer?

We aren't able to provide access to a demo or trial account at this time. You can however request a demo of Sesame by clicking here. Our demos are completely tailored to your use case so you can get a real feel for the value Sesame can deliver for your business.

Insights for trustees

Insights to help you build automated bookkeeping and deliver optimal client service

WHITEPAPER

Automated Bookkeeping for Trustees

Discover the key challenges associated with manual bookkeeping, the data architecture needed for automation and how bookkeeping automation can serve as a foundation for the digitalisation of other trustee services.

.jpg?width=1200&height=628&name=investment-monitoring-Blog_v02%20(1).jpg)

BLOG

The top 5 investment monitoring challenges for trustees

Discover the five largest challenges faced by trustees when it comes to monitoring trust investment portfolios.

BLOG

The data revolution: unlocking potential for trustees

Here are three ways the data revolution is helping trustees futureproof their operations and expand their service offering.

Offices

London Office

52a Cromwell Road

London, SW7 5BE

United Kingdom

Paris Office

140 rue Victor Hugo

92300 Levallois-Perret

France

.png?width=1200&height=800&name=HubDB%20Investment%20Hub%20Graphic%20(1).png)

.png?width=1200&height=800&name=Asset%20graphics%20for%20website%20(1200%20x%20800%20px).png)