Written by Landytech

13 Apr 2023

The role of a trustee is a complex one, and as the world grows increasingly digital, managing assets and ensuring the proper administration of trusts can be an arduous task. In the face of fierce industry competition, trustees are looking for ways to reduce their operating costs and increase their margins. One way for trustees to get ahead is with interoperable data. In this blog, we will delve into the concept of interoperable data, its benefits, and why it is essential for trustees to harness the full power of their data.

What is Interoperable Data?

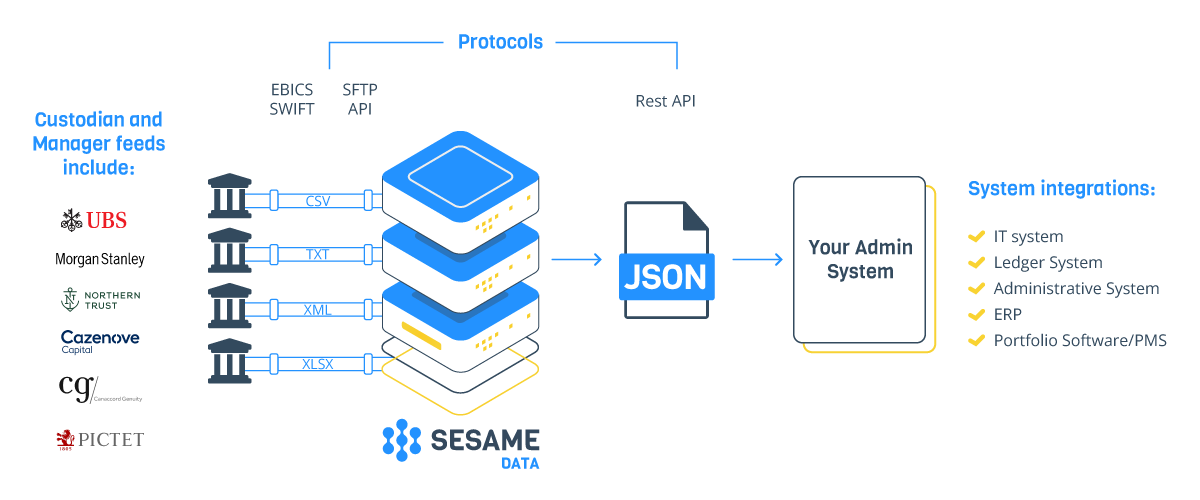

Interoperable data refers to the ability of different information systems, applications, and data formats to work together seamlessly. This means that data from various sources can be easily integrated, exchanged, and processed in a unified manner. For trustees, this can simplify the process of administering assets and monitoring trusts. Where data may previously have been sourced separately for bookkeeping, monitoring and family office services, interoperable data makes it possible to fulfil these activities from a single near-real-time data stream.

An interoperable data feed in a Sesame Data implementation

The Importance of Interoperable Data for Trustees

Trustees often have to collate data from multiple financial institutions, investment and wealth managers. This data can be in different formats, making it challenging to consolidate, analyse, and make sense of it. An interoperable data allows trustees to only go through this process once before disseminating it across the business for multiple uses, such as bookkeeping, monitoring and the provision of family office services. Enabling them to make informed decisions and produce reporting from a single source of truth.

In today’s digital world, the ability to access data in near-real-time is crucial for trustees, as it allows them to make timely decisions, especially during critical situations like market fluctuations or unexpected expenses. By adopting interoperable data, trustees can effectively monitor the performance of trust assets and make well-informed decisions, ultimately benefiting the trust and its clients.

1. A single source of truth

Trust administration often involves collaboration with various stakeholders, from beneficiaries to tax and legal advisors. With interoperable data, trustees can facilitate seamless communication and information sharing among these parties, leading to better decision-making and more efficient trust administration.

By establishing standardised data formats and protocols, stakeholders can quickly access relevant information without the need for tedious manual processes or complicated data manipulation. This not only speeds up the decision-making process but also reduces the likelihood of errors resulting from data inconsistencies.

2. Enhanced monitoring and reporting

Trustees have a responsibility to exercise fiduciary duty, from IPS and transaction monitoring to the production of consolidated accounts. Interoperable data simplifies the data gathering process for these tasks, enabling trustees to seamlessly feed data to the systems used for each workflow. As a result, they can generate accurate reports more quickly for monitoring and reporting purposes.

Furthermore, interoperable data allows trustees to proactively identify potential risks and red flags. For example, investment policy statement breaches and alerts for fraudulent transactions. By having access to comprehensive, up-to-date information, trustees can quickly address compliance issues and mitigate risks, safeguarding clients and their assets.

3. Reduced Operational Costs

The manual process of collecting, standardising, and analysing data from multiple sources can be time-consuming and labour-intensive. By leveraging interoperable data, trustees can automate many of these tasks, which in turn reduces operational costs and allows them to allocate resources to more value-adding activities.

Additionally, the automation provided by interoperable data can lead to increased accuracy and reduced human error. This not only improves the overall efficiency of trust administration but also prevents costly mistakes, at a time where demonstrating.

4. Increased Client Satisfaction

Clients expect timely, accurate, and transparent information about the performance of their trusts and the management of their assets. Interoperable data allows trustees to provide up-to-date information and respond quickly to ad-hoc client queries. At a time where it is more important than ever that trustees offer a differentiated service, this can lead to increased trust and satisfaction among clients, ultimately benefiting the relationship long-term.

By providing clients with access to comprehensive, near-real-time information about their assets, trustees can empower them to take a more active role in the administering of their trust. This not only enhances client satisfaction but also fosters a stronger sense of ownership and engagement.

Unlock the power of your data

The adoption of interoperable data in trust administration is essential for trustees who want to efficiently manage assets, exemplify fiduciary duty, and provide excellent service to clients. By embracing interoperable data, trustees can streamline data management, improve collaboration, reduce operational costs. Ultimately helping trustees better navigate the complex landscape of bookkeeping, monitoring and family office services.

Learn how Landytech is helping trustees realise the benefits of interoperable data.

Related Content

The top 5 investment monitoring challenges for trustees

Trustees have a core fiduciary duty to act in the best interests of their beneficiaries. In order to do so, they must gain an understanding of their long-term goals and aspirations. This is particularly important when it comes to investable assets.

4 Reasons Why Trustees are Building Family Office Services

Trustees have a great opportunity to strengthen their relationships with their clients while enhancing their own competitiveness. Find out how.

In today’s unpredictable world, trustees must constantly adapt to change – whether that’s due to...

Why Sesame is the Future of Trust Bookkeeping & Monitoring

Trustees are under more pressure than ever. Industry consolidation continues apace and competition for business has never been fiercer. All of this at a time where client investment data volumes are mushrooming, requiring more staff than ever, if...

.png?width=1200&height=800&name=HubDB%20Investment%20Hub%20Graphic%20(1).png)

.png?width=800&height=550&name=Asset%20graphics%20for%20website%20(2).png)